Avaloq, the Swiss banking software developer, is putting a bet on renewed growth in China to boost its business as it extends its presence in the Asian growth markets.

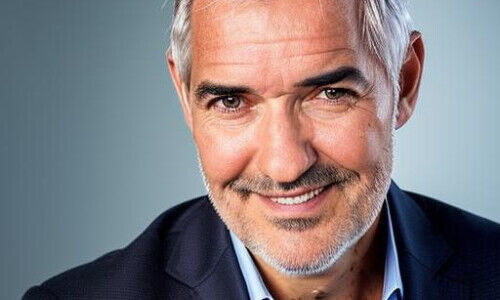

When Peter Scott in 2013 was hired as new head of Asia at Avaloq, the Swiss banking software developer, he received the order to establish the company in the banking hubs of Asia and grow the business. Today, the headquarters of Avaloq Asia on Phillip Street in Singapore is buzzing with activity – little surprise, given that the number of employees has grown tenfold to 200 within a few years.

Apart from the headquarters in the city state, Avaloq has branches in Hong Kong and Sydney and recently opened an outsourcing center (BPO) in Singapore, the first outside the core markets of Switzerland and Germany.

Next Stop: China

Signs are that the period of growth isn't over yet, Scott told finews.ch in an interview: «We are still hiring people,» said the Brit who also aspires to establish the business in China.

Since Scott received his orders a few years ago, the economic tide has turned and the happy times of unfettered growth have been replaced by concern about China's ability to adjust an export-driven economy to stronger reliance on domestic consumption.

Scott is unruffled. «There are a lot of misunderstandings in the West concerning China,» he said. «China is now where the U.S. was in the 1950s: the middle class has no car, no house, but desperately wants to have one.»

Banking Industry Needs to Upgrade Infrastructure

This transitional phase to a more mature capitalist society has much in store for banking (and companies such as Avaloq) in the region, according to Scott. An enormous number of affluent customers are going to demand banking services in China, services that extend beyond the basic retail business.

Asian banks, which will serve most of those clients, are not yet ready to deliver. They lack the IT for the more complex banking services. And that's where Avaloq will try to score, according to Scott, who says that his company has the required technology these banks need.

Swiss Project to Help Adjust

However, the software currently on offer at Avaloq is not necessarily compliant with the retail banking structures in the countries in question. The company will need to adapt its technology to the traditional banking industry in Asia.

Ironically, part of the solution to this problem may come from a joint venture in Switzerland. Avaloq and the Raiffeisen bank in Switzerland have started Arizon, a company that will refurbish the IT of the bank from scratch, a giant project that has numerous challenges to tackle.

«We expect our cooperation with Raiffeisen Switzerland to give us a valuable basis,» Scott told finews.ch.

Reversal of Colonial Past

In Asia, Avaloq has a cooperation project with BT Financial Group (Westpac), a project for Australia. Further customers are China's CITIC Bank International and Singapore's DBS, both aiming to develop their wealth management business.

Scott is also pushing the outsourcing business as private banks in Hong Kong and Singapore face demands to cut costs. The BPO center in Singapore is also helpful for advising Western institutes to outsource their services and may one day extend to Asian banking giants in a reversal of the colonial past. The tide is turning there too and big Asian banks will continue their expansion into the West: «The arrival of the China Construction Bank in Zurich is only one example,» Scott said.