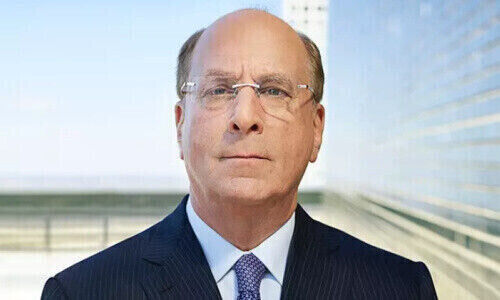

The wizard of Omaha used the annual general meeting of Berkshire Hathaway to call a spade a spade: in his view, hedge funds are a waste of money. UBS won't have liked what the world's most famous investor had to say.

Investors are desperately looking for alternative ways to earn money confronted with an extended period of low interest rates. Hedge fund managers aren't slow to offer their services.

UBS in April published a research paper claiming that hedge funds are unfairly demonized. Switzerland's No. 1 bank increased the hedge fund allocation in its sample portfolio by two percentage points to 20 percent.

Burning Cash

But Warren Buffett, the founder and CEO of Berkshire Hathaway, won't have any of it and suggests that hedge fund investments are a waste of money. At the annual general meeting of his investment company, he claimed that they «eat up capital like crazy,» according to a report by «Bloomberg».

Buffett went on to say that consultants had steered pension funds and others to high-fee managers who, as a group, underperformed, the news organization said.

UBS won't be too happy about Buffett's comments. The wizard of Omaha has a broad fanbase among investors private and institutional, who attempt to copy his investment decisions.

First-Quarter Bonanza

Buffett has once again come up trumps – increasing his profit in the first three months of the year by 8 percent to $5.6 billion compared with a year earlier. His stock added 8 percent in the same period.

Hedge funds meanwhile dropped an average 0.6 percent in value, «Bloomberg» data showed.

Trouncing the Opponing

The 85-year-old legend has a bet running with Protégé Partners, a New York hedge fund, claiming that passive investors over the year do better than if they put their money in the hands of a hedge fund. His bet is worth $1 million.

The betting partners each compare a group of five funds and an investment in the S&P index 500 over a period of ten years.

The bet, which started eight years ago, has Buffett clearly in the lead as he told his shareholders on Saturday. His investment in the S&P has added 66 percent since 2008, while the hedge funds have so far increased 22 percent in value (see comparison).