The recent raids on Credit Suisse office in Europe have a reopened the debate and are a cause for concern for the country’s regulator.

Iqbal Khan, head of international wealth management at Credit Suisse (CS), said he was baffled about the timing of the raids by law enforcement agencies at offices of the bank in the Netherlands and France and a visit from authorities in the U.K.

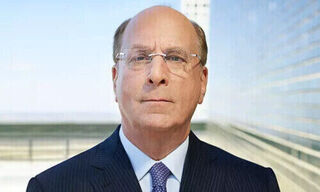

Mark Branson, director of Switzerland’s financial regulator, must have had similar feelings when he was informed by the bank about the investigation. The information at least was «on time», he told journalists at the regulator's annual press conference in Bern.

Actually, he had planned to talk about more uplifting news than yet another case of suspected tax fraud with the help of a big Swiss bank.

Not Informed in Advance

Answering questions about the case, Branson remained understandably cautious in his wording: «We can’t say much about this individual case,» he said first and foremost, presumably because his experts don’t actually know that much.

Finma and Switzerland's prosecturo were not informed about the raids in advance. It would actually have come as a surprise if the foreign law enforcement agencies would have told Finma.

Still: «Nobody likes bad news. They are proof that coming to grips with the past of the wealth management industry will take some time yet.»

Setback for Swiss Banking?

Saying that, the Swiss regulator did not suggest that the current case is something from the past coming back to haunt the bank today: «I can neither confirm nor deny this,» he said.

The probe into the potential existence of accounts containing untaxed money has quickly turned into a story about «the reputation of the Swiss financial market and Credit Suisse» and summarized as a «setback».

The Murky Past

Before we learn more about the results of the investigation, there are three ways of looking at what happened last week:

1. The case belongs to a «murky» past when Swiss private banks didn’t ask any questions about the origin of client assets. That would make CS look pretty bad, because it either overlooked the cases, or bankers duped the compliance officers.

2. The cases occurred despite the best efforts of CS to only accept «clean» money. Even worse for the bank, because then CS has an even bigger compliance problem – which would undoubtedly alert Finma.

3. The interpretation preferred by foreign media and rival financial markets: nothing has ever changed in Switzerland. The attempts to regulate the industry were but a fig leaf and banks continue to harbor dirty and untaxed money. This most unlikely of cases would be the worst-case scenario for Swiss banking.

Paradigm Shift

Finma head Branson is convinced that Swiss private banking has turned the corner: «We have achieved a paradigm shift,» not least with the introduction of the automatic exchange of information, he said on Tuesday.

Still: there’s some way to go as recent corruption and money-laundering investigations in relation to the Malaysian state fund 1MDB showed. Finma completed three investigations last year – against BSI, Falcon Private Bank and Coutts – with sanctions imposed. Four more investigations are yet to be concluded, according to Branson.

The Cambridge-educated transplant doesn’t mince his words: «These cases of the recent past have damaged the financial market and its reputation.»