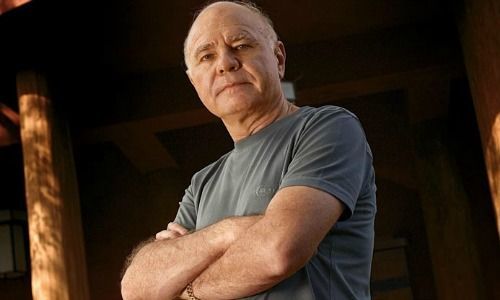

Marc Faber talked himself out of several jobs with racist comments. The outrage in media and finance, where Faber was a sought-after guest, comes late: the stock market guru has long been a bare-knuckled populist.

It was a bridge too far: in his most recent «Gloom Boom Doom» report, Marc Faber got his dander up over how U.S. Civil War monuments commemorating Confederacy leaders are being torn down. Faber described them as «statues of honorable people whose only crime was to defend what all societies had done for more than 5,000 years: keep a part of the population enslaved.»

Never one to cut his losses, Faber also said: «Thank God white people populated America, not the blacks. Otherwise, the U.S. would look like Zimbabwe.»

The backlash against the market forecaster's comments was swift: financial broadcasters said they would no longer book Faber as a guest. Alternative asset manager Sprott demanded – and received – Faber's resignation, and Canadian NovaGold Resources and Ivanhoe Mines said he would also leave their boards. Liechtenstein's Loewenfonds, which Faber advises, might be looking at its options.

Faber's Gonna Faber

But Faber's gonna Faber: he told Swiss tabloid ««Blick» that he didn't expect the reaction, but in hindsight isn't surprised.

«Americans always want to explain to the whole world what is racist and what isn't. But they have an awful history of slavery – which we Swiss don't.» The curious twist of logic is more reminiscent of a spoilt child than a PhD banker with an illustrious career spanning nearly fifty years.

To be clear, his comments on the Charlottesville riots cross the line and are clearly racist. But let's not be quite as shocked that Faber did what he usually does: he provoked, but failed to notice that he had crossed the line to plain racism.

The market commentator has flourished by second-guessing powerful policymakers, central bankers and paper money, and banks which always sell rosy market scenarios to clients. The only true investment? Gold.

Pricey Gigs

The personality cult took hold: Faber was taking in as much as 20,000 Swiss francs a pop for frequent appearances in Switzerland to investors and at company events. For a time in the early 2000s, the Thailand-based guru advised Credit Suisse's fund business.

His western business partners doubtlessly find Faber's views on racial unrest in the U.S. odious – and they are. But this week's backlash comes late for those who have followed the market doom peddler in recent years.

The controversial Zurich native correctly predicted the U.S. stock market crash in 1987, the Asian crisis in the 1990s and the dot-com bubble bursting in the naughties. As a German robo-adviser recently showed, Faber more recent predictions are about as reliable as a coin toss – he was correct in 47 percent of 150 market recommendations (in German).

Langstrasse Habitue

Despite the spotty record, «Dr. Doom» was still regularly booked in financial powerhouses like «Bloomberg» and «CNBC». finews.com also frequently featured the pony-tailed pot-stirrer.

The media and financial scene happily overlooked his regular excursions into the red-light milieu. For example, he bragged to Swiss newspaper «Schweiz am Wochenende» (story in print edition only)that prostitutes were expensive in Zurich, but cheaper than in Paris, Rome or Greece.

The media were only too willing to accompany Faber on his night-time jaunts in Zurich's Langstrasse area, the heart of the city's bustling sex and drug trade. The backlash against Faber for his racist comments today is entirely justified, but nevertheless rings hollow.