The word of Nicolai Tangen carries considerable weight among powerful investors. finews.com met with the head of the world's largest sovereign wealth fund on the sidelines of a Symposium, where he reflected on Credit Suisse and UBS.

Nicolai Tengen, you are the biggest investor in Switzerland. Is this just because you are the world’s largest sovereign wealth fund or do you have a Swiss bias?

The sovereign wealth fund managed by Norges Bank Investment Management (NBIM) is the largest single investor in the world's equity markets, with 1.4 percent. The equity share in Europe is slightly higher at 2.6 percent of listed companies. Overall, however, we invest broadly across countries, sectors, and currencies. We do not have a preference for Switzerland, even though I hold the country in high regard.

The sovereign wealth fund suffered its biggest loss since the global financial crisis in 2022, with 152 billion euros. To what do you attribute this to?

Last year, assets equivalent to 25 times the size of the NBIM were wiped out on the capital markets due to the market turmoil. This enormous collapse directly affected, among others, the American Silicon Valley Bank and the Swiss Credit Suisse.

You mention the turmoil in the banking sector. Is the worst behind us?

The failure of these banks, while regrettable, is not a sign of a systemic crisis. Rather, the situation reminds me of the game in which moles that emerge from various holes have to be knocked back into the holes with a hammer. So we must remain vigilant and act decisively when something unwanted appears somewhere.

How well-managed was the collapse of Credit Suisse? To what degree is the reputation of the Swiss financial center damaged?

The Swiss government took the right steps to rescue Credit Suisse. In doing so, it prevented an uncontrollable situation in the Swiss financial center and beyond.

«The signs changed when UBS took over Credit Suisse»

There is no doubt that you can never do everything perfectly in such an extraordinary situation. But I am convinced that the decisive intervention of the Swiss authorities has in no way undermined confidence in the country.

The sovereign wealth fund reduced its stake in Credit Suisse to around one percent in March. Which red lights prompted you to withdraw?

Our withdrawal started quite a bit earlier because there had been many red flags over a longer period. We significantly reduced our shareholding in Credit Suisse, particularly after the debacle with the family office Archegos.

How did you react to the emergency takeover by UBS?

The signs changed when UBS took over Credit Suisse. We bought additional UBS shares after the big bank received the commitment to buy its rival. Our shareholding in UBS now stands at 4.5 percent.

«We see ourselves as an index-tracking investor»

This is a positive and fair deal that would hardly have been waved through in normal times. UBS's strategy will indeed be diluted somewhat with the takeover. But this will be offset over time by the merger with Credit Suisse. Moreover, we have great confidence in UBS's management to master the integration.

NBIM voted against the re-election of several board members at the Credit Suisse AGM. Would you also participate in legal actions if they were taken against the management and the board of directors of Credit Suisse, for example?

We are not ruling that out. Our lawyers are currently looking into the case and following the discussion closely. However, it is too early to commit to legal action based on management failure at Credit Suisse.

Is NBIM also affected by the write-down on the AT1 bonds issued by CS?

No, we have not invested in the AT1 bonds issued by Credit Suisse. Therefore, these lawsuits do not affect us.

70 percent of your assets are invested in global stocks. What is your investment approach in these difficult markets?

We see ourselves as an index-tracking investor. On the one hand, we are guided by benchmarks set by the Norwegian Ministry of Finance. On the other hand, as investors, we can quickly reposition ourselves within our risk budget and weigh shares of individual companies differently from the index.

«When it comes to compensation, we take a closer look if the packages are unusually high»

An example of this is the active decision just mentioned to increase our equity position in UBS. When the acquisition was announced on March 19, our bank analysts concluded that it was an attractive long-term deal. The next day, we put this recommendation into practice.

As the largest single shareholder in the world, the market power of the Norwegian sovereign wealth fund is great. You also started with the promise to exert more influence. Where is this visible?

Of course, we don't interfere in the operational management. But as a major shareholder, we do exert more pressure to get the company to move in the direction we prefer. In this way, we can insist on a plan to ensure that the company operates in a more climate-friendly way. In terms of governance, we reject for instance the roles of CEO and Chairman of the Board being held by the same person.

And what are you doing about the sometimes emotional debate about bonuses?

When it comes to compensation, we take a closer look if the packages are unusually high. In the U.S., the threshold is around 20 million dollars. We only approve such lavish pay packages if they are justified by performance, transparent, long-term, and equity-based.

However, it also happens that you refrain from certain investments. For example, you do not own shares in Saudi Aramco, the world's largest oil production company. Why?

That is correct. We refrain from investing in the company because the sovereign wealth fund invests based on a reference index whose securities are filtered according to ESG criteria (environmental, social, and governance). In this context, Saudi Arabia does not meet the requirements. The starting point for the reference index is the FTSE Global All Cap Index.

How do you go about excluding investments?

On the one hand, an independent ethics advisory board can tell us to exclude individual companies as investment objects.

«Currently on the blacklist are investments in tobacco, coal, and certain weapon suppliers»

On the other hand, we in the SWF can decide for ourselves, within the framework of our risk budget, which investments we stay away from. Currently on the blacklist are investments in tobacco, coal, and certain weapon suppliers.

Ultimately, however, no one is helped if investors ignore sensitive areas. That's why you're seen as an advocate of change through shareholder dialog. As the head of the world's largest sovereign wealth fund, how do you go about helping sustainable investing achieve its breakthrough?

The most important thing is to set strong and clear expectations to commit a company's management to a climate-friendly economy. That's why, last year, we drew up a large, detailed climate plan aligned with the Net Zero Allianz targets.

In your role as head of NBIM, the doors to CEOs around the world are open to you. You also maintain good relations with Swiss captains of industry. What distinguishes the Swiss business world?

I observe a systematic way of working that is expressed with great care and thoroughness. I am therefore not surprised that the country has produced so many outstanding companies with these virtues.

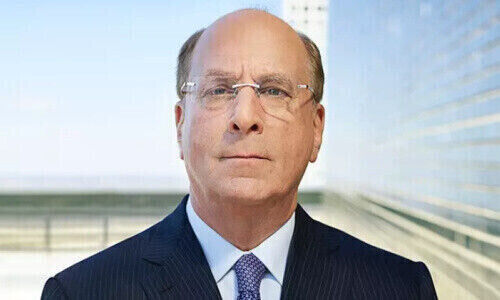

Nicolai Tangen has been CEO of the sovereign wealth fund managed by Norges Bank Investment Management (NBIM) since September 1, 2020. Previously, he was CEO and CIO at AKO Capital, which he founded in 2005. In 2013, he established the AKO Foundation, which supports nonprofit initiatives to improve education, promote the arts and mitigate climate change issues. Tangen holds a bachelor's degree in finance from the Wharton School and master's degrees in art history from the Courtauld Institute of Art and in social psychology from the London School of Economics.