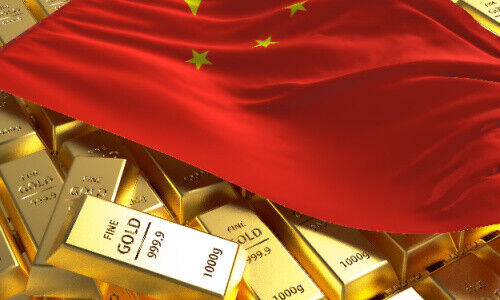

The People’s Bank of China increased its reserves faster than anyone else last year. Whether it is due to geopolitics or prudence is anyone’s guess.

China bought 225 metric tonnes of gold in 2023, bringing its reserves to a total of 2,192, an infographic released by Visual Capitalist on Wednesday indicates (based on Federal Reserve, IMF, World Bank, and World Gold Council data).

The conventional wisdom might be that it is a hedge against the fraught geopolitical situation between the mainland and the US - or a way of bolstering its currency in the difficult economic circumstances the country finds itself in.

Playing Catch Up

But when looking at the larger context, it seems clear that China is still playing catch up with the other major central banks of the world.

It currently has exactly two times the gold reserves that the Swiss National Bank (1,040 tonnes) has. That is not all that much when you consider the vast disparity between the two countries.

Bars per Capita

The Swiss population? Almost 9 million - a sharp contrast to the more than 1.4 billion individuals in China, with GDP currently about 1/17th of that on the mainland. In other words, that is a high number of gold bars per capita for every Swiss resident.

But the same thing holds for other countries in the Asia Pacific region. Japan has a low level of central bank gold reserves (847 tonnes) as does India (801 tonnes). You could even see the latter as a paltry sum for what became the world’s most populous nation in 2023, particularly given the societal importance of gold, other precious metals, and jewelry.

High Reserves

Other countries with significantly higher reserves than China despite having far lower populations and smaller economies include France (2,437 tonnes), Italy (2,452 tonnes), and Germany (3,353 tonnes). However, the Federal Reserve’s holdings, at 8,133 tonnes, continue to significantly surpass those of all other central banks.

As the online publisher indicates, gold, which hit record levels in December, remains an important store of value and a hedge during economic crises.

Key Impetus

It also enhances confidence in general economic stability. Moreover, one-fifth of all the gold ever mined is still held by central banks.

That last fact is likely to have been one of the key impetuses behind the mainland’s attempt to further bolster its reserves last year - even though the facile answer would seem to lie in geopolitics and economic uncertainty.