The physical model that explains ferromagnetism can also be used to predict market developments, says Stefano Lecchini, portfolio manager at LGT Capital Partners.

At first, predicting market developments by incorporating the decisions made by each individual investor appears very complex. This is because if one considers all investors as a sum of individual decision-makers, it would be necessary to take a whole series of variables into consideration:

Every investor (i, i=1,…,N) reaches their decisions D(i) – for example, to invest more money or to withdraw capital – based on their personal situation P(i) – such as current needs, available funds – and their assessment S(i) of how the market will develop, or in other words, if it will make gains or correct downwards. In addition, both rational considerations, as well as irrational motives, are incorporated W(i) into the investor’s final decision. The decision D is, therefore, a complex function:

D = f(P,S,W)

We could only predict investor behavior and thus market developments if the values of all investors for these variables and the complex correlation between them were known to us.

Investor Sentiment as a Deciding Factor

So let us simplify the task somewhat by focusing on variable S. To do so, we disregard both the situation of each individual investor P as well as their decision-making patterns W. The decision D now depends only on the investors’ assessment S, which we can also call «sentiment».

In other words, each individual investor decides to invest when they assess future market developments as positive (S(i) = +1) and vice versa: they withdraw funds when the assessment is negative (S(i) = -1). To put it simply, the sum of the decisions of all investors, therefore, corresponds to their market assessments D(i) = S(i).

Variable S has two values: +1 or -1. The average thereof is relevant for market developments: if it is positive, the market will soar, because the majority of investors will actively invest. However, if the average is negative, the bulk of investors will withdraw from the market and the market will correct downwards.

A Dynamic Model

Investors change their minds from time to time, which can, on the one hand, be attributed to the fact that they mutually influence each other. On the other hand, new information also has an impact on the investor community. This information can be categorized as positive, neutral or negative. For example, news containing statements about positive market developments have a positive impact on investor sentiment and vice versa.

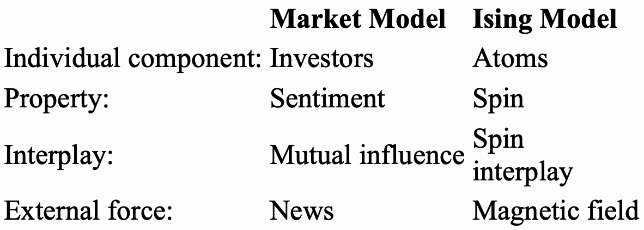

The model is therefore dynamic and consists of three elements: investor sentiment, the interplay between investors and the external influence of news. It thus has certain similarities with the Ising Model, a physical model that was introduced to explain ferromagnetism. Ferromagnetism is the best-known type of magnetism of solids and explains why, for example, pieces of iron are attracted to a horseshoe magnet. A comparison of the two models shows the following:

Applying this physical model makes it possible to gain interesting insights into the dynamics of investor sentiment: news acts like a magnetic field and influences the «approach» taken by investors. The Ising Model shows that a piece of iron retains magnetic properties if it has been exposed to a magnetic field. Under this analogy, the assumption that news impacts investor behavior for longer than thought gets a tangible representation.

Physics in the World Finance

Such insights can also be used to develop a trading strategy based on investor sentiment. These strategies use the influence of news to make market predictions. A team at LGT Capital Partners applies exactly this approach: the team has developed a very detailed, dynamic model for investor sentiment à la Ising.

In order to extract solutions from this complex, multidimensional sentiment model, they use modern technologies such as natural language processing and machine learning to determine a corresponding market position (long or short). This is an interesting example of how physics has found concrete application in the world of finance.

Stefano Lecchini is a portfolio manager at LGT Capital Partners and develops hedge fund solutions for institutional clients. He has a master’s in theoretical physics from ETH Zurich and a master’s in philosophy from the University of Bern. After completing his studies, Lecchini gained initial professional experience in the areas of consulting and investment banking.